Managing your finances in 2025 isn’t just about saving receipts or checking your bank balance occasionally. With today’s smart digital tools, changing economic trends, and rising living costs, budget tracking has become an essential skill for anyone wanting financial stability.

Whether you’re a student managing tuition, a freelancer juggling irregular income, a small business owner, or simply trying to control your everyday spending—these 10 tips will teach you how to track your budget like a pro this year.

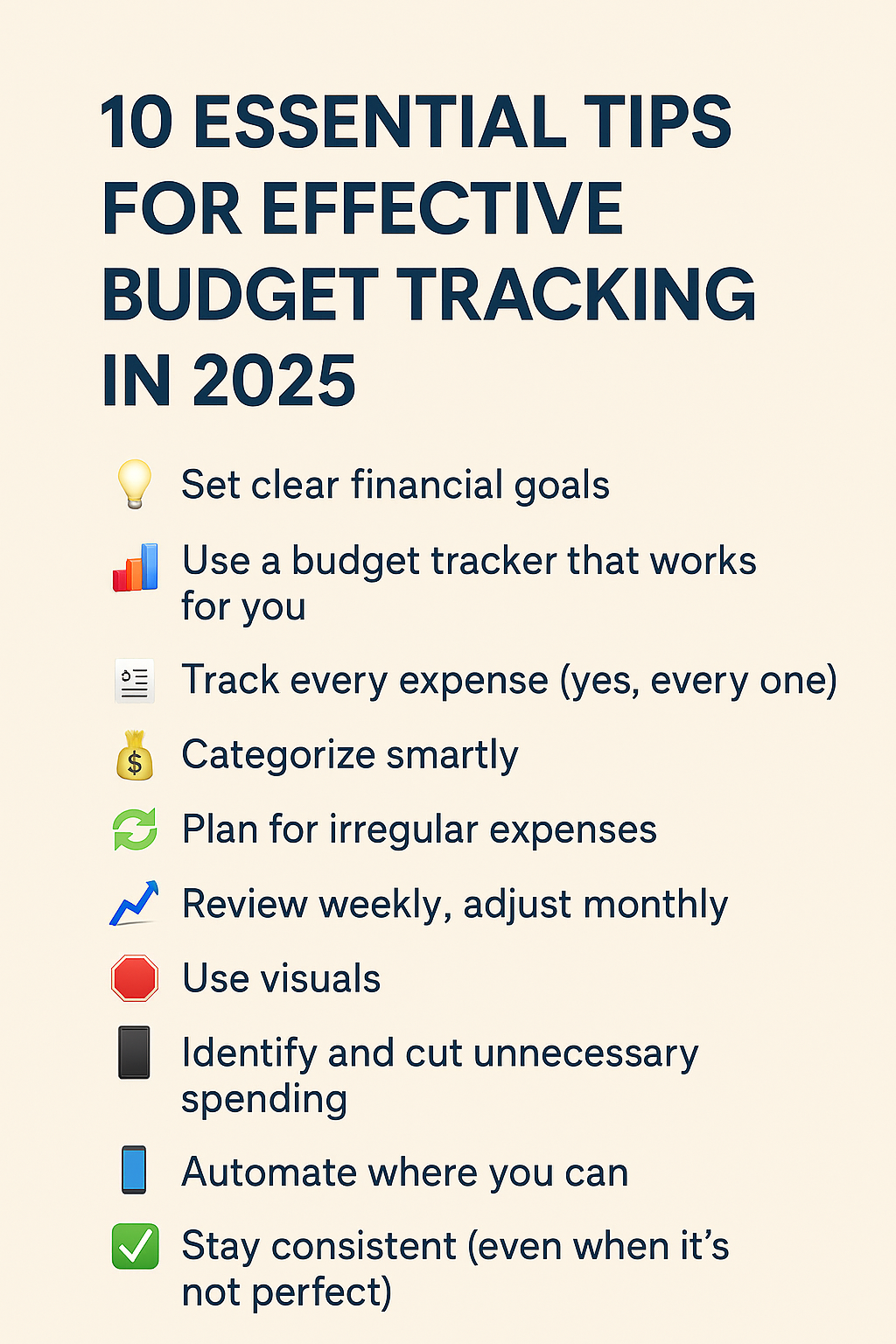

💡 1. Set Clear Financial Goals

Purpose fuels discipline.

Before you even touch a budget tracker, decide what you’re working toward:

- Saving for a vacation?

- Paying off credit card debt?

- Building a home down payment?

Short-term and long-term financial goals give your budgeting efforts meaning—and make it easier to stay motivated when challenges pop up.

Pro Tip: Break large goals into smaller, bite-sized targets. Saving $5,000 sounds intimidating, but saving $100 a week feels achievable.

📊 2. Use a Budget Tracker That Fits You

The best budget tracker is the one you’ll actually use.

Explore popular digital budgeting tools for 2025:

- Spreadsheets: Google Sheets, Microsoft Excel, Notion templates

- Apps: YNAB (You Need A Budget), EveryDollar, Goodbudget

- Platforms: Tiller Money, Monarch Money, PocketGuard

Why it matters: If you hate the system you’re using, you’ll abandon it quickly. Choose a tool that matches your habits—whether you like automation, flexibility, or hands-on control.

Pro Tip: Spreadsheets offer endless customization if you love tweaking and tracking every detail.

🧾 3. Track Every Single Expense (Yes, Even Coffee)

Small leaks sink big ships.

It’s easy to ignore tiny transactions, but over time, those small charges add up. Daily expense tracking builds awareness—and keeps your spending habits transparent.

Ways to track easily:

- Use a mobile budgeting app

- Keep digital receipts

- Set a reminder to log expenses once daily

📅 4. Categorize Expenses Smartly

Clarity helps you prioritize.

Organize your expenses into smart categories, such as:

- Needs: rent, groceries, insurance, utilities

- Wants: dining out, Netflix, shopping

- Savings/Debt: emergency fund, retirement, credit card repayment

Bonus: Break major categories into subcategories for ultra-clear insights (e.g., under “groceries” split into produce, snacks, household goods).

💰 5. Plan for Irregular Expenses

Prepare for the predictable surprises.

Some expenses aren’t monthly—but they always come around. Common examples:

- Car repairs

- Medical bills

- Holiday gifts

- Annual insurance premiums

- Subscription renewals

Solution: Create a sinking fund—where you set aside a small amount each month to cover these future expenses.

Example: If your car insurance is $1,200/year, save $100 per month into a designated fund.

🔄 6. Review Weekly, Adjust Monthly

Small corrections prevent major problems.

Weekly Routine:

- Review all expenses

- Confirm you’re staying within limits

- Adjust for emergencies or changes

Monthly Routine:

- Analyze spending vs. budget

- Update your spending categories if needed

- Set new goals based on last month’s trends

Why weekly and monthly reviews matter: It’s far easier to fix small mistakes weekly than to fix huge overspending months later.

📈 7. Use Visuals to Stay Motivated

Your brain loves pictures more than spreadsheets.

Visualizing your progress makes budgeting feel more tangible—and a lot more satisfying.

Ideas for visual budgeting:

- Create pie charts showing category percentages

- Set up bar graphs comparing planned vs. actual spending

- Use dashboards that color-code expenses

Pro Tip: Google Sheets and Excel both offer easy chart creation tools. Many budgeting apps also generate graphs automatically.

🛑 8. Identify and Cut Unnecessary Spending

Find your “money leaks” and plug them.

Budget tracking often reveals surprising truths about your habits. You might discover:

- Forgotten subscriptions

- Frequent fast-food runs

- Late payment fees

What to do:

- Cancel unused services immediately

- Set limits for fun categories like dining out

- Create a free “fun budget” to enjoy treats without overspending

📱 9. Automate Where Possible

Work smarter, not harder.

Automation builds consistency. Smart moves include:

- Automatic savings transfers right after payday

- Bill pay automation for recurring charges

- Bank alerts for low balances or big transactions

Benefit: Automation reduces the temptation to skip savings goals or forget bills, giving you peace of mind.

✅ 10. Stay Consistent (Even When It’s Not Perfect)

Consistency wins over perfection every time.

You won’t hit every goal every month—and that’s normal. The most successful budgeters aren’t perfect; they’re persistent.

Tips for long-term consistency:

- Celebrate small wins (like staying under budget in one category)

- Forgive yourself for setbacks

- Remember: progress > perfection

🔚 Final Thoughts: Build a Budget That Works for Your Life in 2025

Budget tracking in 2025 doesn’t have to feel overwhelming.

With the right tools, simple routines, and a little patience, you can build a system that gives you full control over your financial future. Whether you’re chasing big dreams or just trying to breathe easier month-to-month, smart budget habits start with these ten essentials.

📥 Ready to Simplify Your Budget Tracking?

We’ve created plug-and-play budgeting spreadsheets built for 2025’s financial world—designed for clarity, speed, and total control.

✅ Monthly & yearly dashboards

✅ Auto-categorization templates

✅ Built-in charts & graphs

✅ Zero learning curve

👉 Shop Budget Trackers Now

Take the first step toward smarter, simpler money management today!